The flow of money into the UK’s retail logistics sector hit a record high of £4.7bn during 2020, as investors shifted cash from office properties and shopping centres to e-commerce. Real estate advisor Knight Frank forecasts that for every additional £1 billion pounds of online retail sales in the UK, another 126,000 sqm of warehouse space will be necessary.

US consumers spent an estimated US$245 billion online during 2020, moving up to more than one-fifth of the nation’s total retail spend. That increase, up from $185 billion in 2019, has kept warehouse developers busy – almost 29 million square metres of storage space was under construction in the third quarter alone.

“What was a fledgling service is now mainstream with many retailers investing more and more in the technology that powers online retail.”

As e-commerce rapidly grew while stores were closed during the COVID-19 pandemic, the warehouses and distribution channels that are the backbone of online trade tried to keep pace.

“The warehousing sector has gone from strength to strength in the UK, partly fuelled by the coronavirus, with lockdowns forcing people to move to online retailing,” says Brendan Sharkey, the head of construction and real estate at MHA Macintyre Hudson in the UK.

“Brexit has also been a factor, with retailers stocking warehouses in the UK as a way of hedging against potential import issues from mainland EU countries.

“What was a fledgling service is now mainstream with many retailers investing more and more in the technology that powers online retail.”

Securing warehouse space and managing the logistics of online purchases and delivery has been challenging enough in countries where e-commerce already existed, let alone in places where the sector has taken off almost overnight.

In Russia, there are at least 17 new warehouse projects covering more than 300,000 square meters, while Amazon added new logistics centres in Brazil, adding 75,000 square meters (807,000 square feet) of distribution space in the biggest project since it began operating in Brazil in 2012.

Rapid retail switch creates issues

Getting the logistics right in the online retail space is everything because, as MHA Macintyre Hudson’s Rajeev Shaunak points out, up to a third of their costs can be that last mile of distribution.

“Take Ocado, the online shopping platform started in the UK many years ago, I don’t think have ever made a profit from their online sales, almost certainly because of the cost of distribution.

“Amazon have stepped into that and are now actually doing food deliveries because they’ve already got that infrastructure and logistics set up.”

Elena Dmitrieva, Partner, Corporate Finance at Baker Tilly Russia, says almost everyone in the e-commerce market was influenced by logistics troubles and difficulties because of the speed of change that came upon the market as the pandemic spread in the spring.

“Nobody was prepared to such extreme growth of demand for logistics, for transportation, for delivery services,” she says.

“From our clients’ perspective, as we have some logistics companies and companies who own commercial real estate in and around Moscow and large cities, at first those companies struggled.

“It was a huge demand for trucks, logistics people, persons and couriers simply, and to deliver goods and to restructure the logistics chains because most of the logistics chains were based on real stores.

“This old logistic system needed to be restructured very quickly to serve that growth in e-commerce.

“Now, there are 17 new projects for warehouses around Moscow from big developers, starting from 5000 square meters to 20 or 30,000 square meters. And they are not simply warehouses, but logistics centers.”

Having emerged from that sudden change, Ms Dmitrieva says there is a skills shortage in Russia in the logistics sector.

“It will be difficult for medium and small enterprises to develop the logistics capabilities at this time. But partnering has been the right way to proceed in a flourishing market.”

“Large domestic food retailers, they had already their own logistics centres, or they’re now in the process of buying warehouses and building logistics centres, hiring personnel for the logistics part of the work,” she says.

“One of our clients made a HR search for the top professions which are in high demand in the labour market now, in the top 10 is logistics.

“The combination of two things, IT expertise and logistics expertise, are the top skills of people who are needed for a lot of retailers now.”

Manuel Aguilar, Managing Partner at Baker Tilly Mexico, says a key success factor for retailers in Mexico at a time of rapid e-commerce growth, has been joining with a logistics partner.

“It will be difficult for medium and small enterprises to develop the logistics capabilities at this time,” he says.

“But partnering has been the right way to proceed in a flourishing market, even with a pandemic that has impacted hospitality, restaurants, and for sure retail, there are new distribution channels.”

Similarly in Brazil, Leonardo Maia, Partner at Baker Tilly Brazil, said there a level of M&A activity, especially in the logistic safeguard of assets, as well as customer behaviour, as companies sought to tap into existing expertise to fuel their growth.

“Everything that is related to artificial intelligence, customer behaviour, so small tech companies related to analytics and things like that was the focus of M&A activity.”

Online market or manufacturer direct?

For the US, the UK and a significant part of the western world, Amazon is the dominant marketplace platform, with eBay a distant second. But the market is more open in other parts of the world.

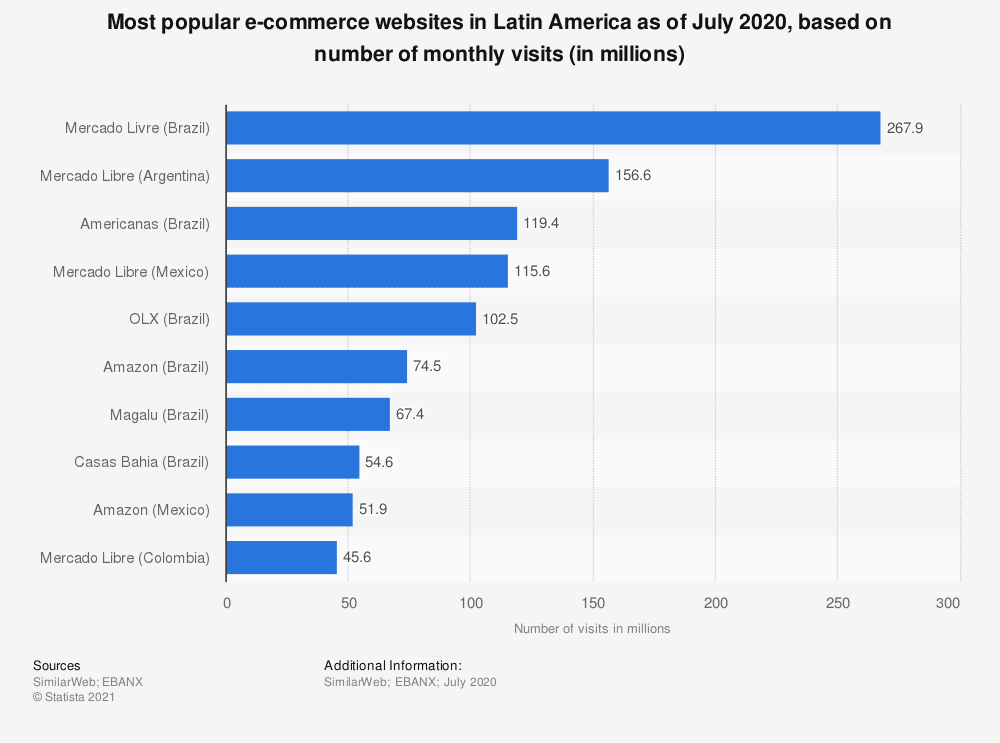

In July 2020, Mercado Libre Mexico had an estimated monthly traffic of 106.5 million visits, making it the most popular e-commerce platform among consumers in that country, with Amazon ranked second. Mercado Libre was also the dominant player in Brazil, ahead of Americanas and OLX.

Start-up marketplace platforms are enjoying rapid growth within South East Asia or Latin America, two regions that will drive e-commerce growth in the coming years.

Shopee, with its platform of free deliveries and low commissions, has become Vietnam’s most popular e-commerce platform, growing its website visits to 62 million a month during the third quarter of 2020, an increase of more than 80 per cent.

The platform, owned by Singapore-based SEA Ltd, has targeted Latin America as a key growth area, with its e-commerce sales growing by 36.7 per cent during 2020 to almost US$85 billion, making it the fastest growing region for e-commerce in the world.

Yet, for all the explosion in online marketplaces, Maxim Tambiev, a research consultant for Baker Tilly Russia, says many retailers are taking responsibility for their own storage and delivery operations.

“The interesting part is that 65 per cent of the shipments were done by the retailer’s own logistics operations but parcels made by Russian Post, which is the largest postal system in Russia, substantially fell last year,” he said.

“Of course, the independent logistics operations really grew in terms of number of shipments and in terms of number of points that can be used for delivery. For example, the Automated Parcel Terminals (Parcel Lockers) networks really grew throughout Russia. They were not very popular beforehand but during the pandemic it became one of the most widespread means of delivery.”

“You can’t have an unlimited shelf yourself in the warehouse, so your distribution system needs to be able to not lose sales by not having anything, but being able to easily tap on to the manufacturer.”

Rajeev Shaunak says while huge marketplaces like Amazon and Alibaba have built up a massive distribution, retailers are finding it is not the only way forward.

“If you’re buying things like sports trainers and stuff through something like JD Sports, quite often they’re shipped direct from Adidas or Nike, they’re not necessarily in their warehouses,” he says.

“That pressure on warehouses continues to grow purely because the expectation of consumers has massively grown, every time they shop online, they expect to see every good new goods.

“Manufacturers are trying to meet that, but you can’t have an unlimited shelf yourself in the warehouse, so your distribution system needs to be able to not lose sales by not having anything, but being able to easily tap on to the manufacturer.

“Travel agents are able to go straight to the airlines and the hotel’s own systems and source the sale directly by having a logistics system, I think they call it GDS, Global Distribution System.

“Having a means of actually tapping into your key manufacturers and seeing they’ve got the stock to be able to fulfill this sale, rather than the fact that you’re limited by your warehouse capacity, is going to be very important.”

The challenge for retailers, says Mr Aguilar, is improving the logistics channels, either by developing those capabilities internally or finding the right partner to grow with. But partners are scarce because of high demand and internal development takes time.

“The utopian convenience of ordering something on the smartphone and getting that on the next coming day is testing a lot of things, not only the retail, but as well the resourcing of that retail supply chains and so on,” he says.

Mr Maia says online retailers would also do well to remember general lessons taken from the last 12 months, where the fragility of supply chains was exposed.

“After those difficulties that every country has passed through, considering the vaccines and the supply side like the medical suppliers, everything that is related to the pandemic, all those major supply chains are being actually revised to make sure that we have a plan B if our major supplier doesn’t support us, as we saw in the first semester with China and the pandemic,” he says.