Bringing production closer to home is emerging as a solution for many major companies headquartered in Western Europe. Baker Tilly analyses the costs of doing business in 12 Central and South Eastern European countries.

As inflation soars and supply chains continue to buckle under the strain of the pandemic, Central and South Eastern Europe is becoming an attractive proposition for many manufacturers.

Nearshoring, or relocating operations closer to home, is expected to pick up strongly in 2022, even as many parts of the European economy are emerging from the COVID crisis,

Ongoing supply chain disruption remains a key driver of the change, as the cost of doing business internationally continues to climb, with increased shipping costs, road transport and fuel expenses, and shortages of everything from materials to labour, to warehousing.

As an example, global research house Drewry’s World Container Index shows a 40-foot sea container currently has an average cost of more than $US9,300, some 220 per cent higher than the five-year average.

Compounding the increased shipping costs is a major spike in energy prices, which helped propel inflation across the Euro Area to an all-time high of 5.1 per cent in January.

And many economists warn that persistent bottlenecks, labour shortages and shipping backlogs will cause disruption for at least another two years, a trend towards de-globalisation that started to gather momentum prior to the pandemic is expected to accelerate.

But while nearshoring strategies are becoming increasingly common for major companies in Western Europe, it is a complex undertaking with a vast array of factors employers need to consider, according to experts at TPA Group, part of the Baker Tilly Europe Alliance.

“Nearshoring is very important, because many countries have problems with their supply chains,” TPA Group Partner Klaus Bauer-Mitterlehner said.

“But it is hard work for a lot of companies that are really thinking about going back to Europe.”

Comparing costs for smarter business

TPA Group recently collaborated with personnel consulting firm Kienbaum to compare the costs for managing directors, executives, white-collar workers and blue-collar workers in 12 countries in Central and South Eastern Europe (CEE).

The study, which was conducted prior to the escalation of conflict in the Ukraine, analysed personnel costs, tax rates, social insurance contributions for employers and employees, and other non-wage labour costs.

The costs of doing business was analysed and compared in Austria, the Czech Republic, Slovenia, Slovakia, Poland, Croatia, Hungary, Montenegro, Romania, Bulgaria, Serbia and Albania.

“You can see a lot of companies from Western Europe expanding, particularly in the production sector but also in information technology,” said Thomas Haneder, a member of TPA Group’s CEE management team.

“They are expanding to these countries and opening factories and technology hubs.

“We wanted to provide an overview of what the levels of wages are, what the total costs of doing business in each country are and what the net income is for employees there.

“Nearshoring is very important, because many countries have problems with their supply chains.”

“It was important for us to highlight this to provide insight to investors considering these countries in times of nearshoring due to the coronavirus crisis, when not every company wants to outsource their production to Asia.”

Mr Bauer-Mitterlehner said much of the interest from relocating firms was focused on the countries surrounding Germany and Austria, in the Czech Republic, Poland, Slovakia and Hungary.

“Those are all members of the European Union, they all still have relatively low costs and a lot of certainty, which is always going to garner a lot of interest,” he said.

“Then you have the Balkan area, the south-east area, some of them are not yet in the EU, they are a little bit smaller, but they are gaining more interest from companies wanting to relocate their headquarters there.”

Mr Haneder said the relative proximity of the CEE countries was also a big factor driving the nearshoring trend.

“From Vienna, it’s a one-hour flight to Belgrade, it’s about a one-hour flight to Sofia in Bulgaria,” he said.

“There is a historic link to these countries, it’s a similar culture, and it is easier to expand business to these countries than expand to China, for example, because you understand the culture.

“This region is in focus for the production industry because it’s close, it’s understandable and it’s legally certain.

“Companies know that some things might need to be looked at and there’s not always the high degree of legal certainty that you have in Western European countries, on the other hand that’s what you expect and what counts is logistics.”

Mitigating risk through local knowledge

While the options for controlling costs are significant, Mr Haneder said employers looking at a shift to some CEE countries needed to acknowledge certain risks.

“These are developing countries, and they have progressed a lot already, and legal certainty is much higher than it was 10 or 20 years ago,” he said.

“But sometimes you have political instability.

“If the systems change or the governing party changes, it might have an effect where taxes are changed completely, or special taxes are introduced in certain industries, as we have seen in Hungary.

“These are the risks investors have to live with.”

Mr Haneder sees these downside risks as similar to what investors or company directors face when considering doing business in Asia.

“In some Asian countries it is challenging because you have limited control,” he said.

“But in South Eastern Europe, these countries are smaller, and if you are a big investor, you can get to the deciding person in a much easier and quicker way.

“It is never a guarantee that you will be successful, but at least you can raise issues.

“Embassies have a big role in these countries, ambassadors have good access to governments, but it has to be said that legal and political risk is always there and needs to be well-considered.

“But I would not overestimate it, particularly in EU countries.”

Finding the right location for talent

Of the 12 countries evaluated in the study, Mr Haneder said it was no surprise that Austria was ranked first by a wide margin for total costs, followed by neighbouring Slovenia, the Czech Republic and Slovakia.

Ranking in the middle were Poland, Croatia and Hungary, while total costs were low in Montenegro, Romania, Serbia and Bulgaria, with Albania recording the lowest total costs for all groups of employees.

Talking about tax

While overall costs are the logical starting point when evaluating where to relocate, Mr Bauer-Mitterlehner said that tax implications across borders were particularly crucial for employers.

“At the end of the day, it was clear that the non-EU companies were the cheaper ones,” Mr Bauer-Mitterlehner said.

“That was no surprise, but you have to see that some countries have a flat tax regime or a ceiling on social security.

“This has a very big impact when you talk about different income classes or different levels of income.

“For example, in Austria, the more you earn, the more you contribute to social security and the more tax you pay.

“Interestingly, in some of these countries, that’s not necessarily the case.”

Mr Haneder agreed that the structure of those costs was also important to consider.

“We are talking about the relative levels, in absolute figures, of course you always pay more, even in countries like Bulgaria or Albania, you always pay more in absolute figures, even if you have a flat tax rate of 10%,” Mr Haneder said.

“But on a relative level, the study found that a blue-collar worker who may not earn that much will contribute relatively less, so their net income as a percentage of the total costs is in some countries lower than for a well earning director.

“For our main target group for the study, which is companies who are interested in expanding to these countries, the most relevant metric of course is total costs.

“But also important to them is the structure; how much of the total costs are paid to tax and how much remains in net income is also interesting.

“With this data companies can determine whether their employees will be satisfied with these kinds of salaries.

“If a lot of social contributions and taxes are due, then you might have to think about the situation.

“And you also may have to consider that some companies will pay their employees on a net level and may not pay them the full amount officially, and these are the companies with which you have to compete.”

Looking at factors beyond income

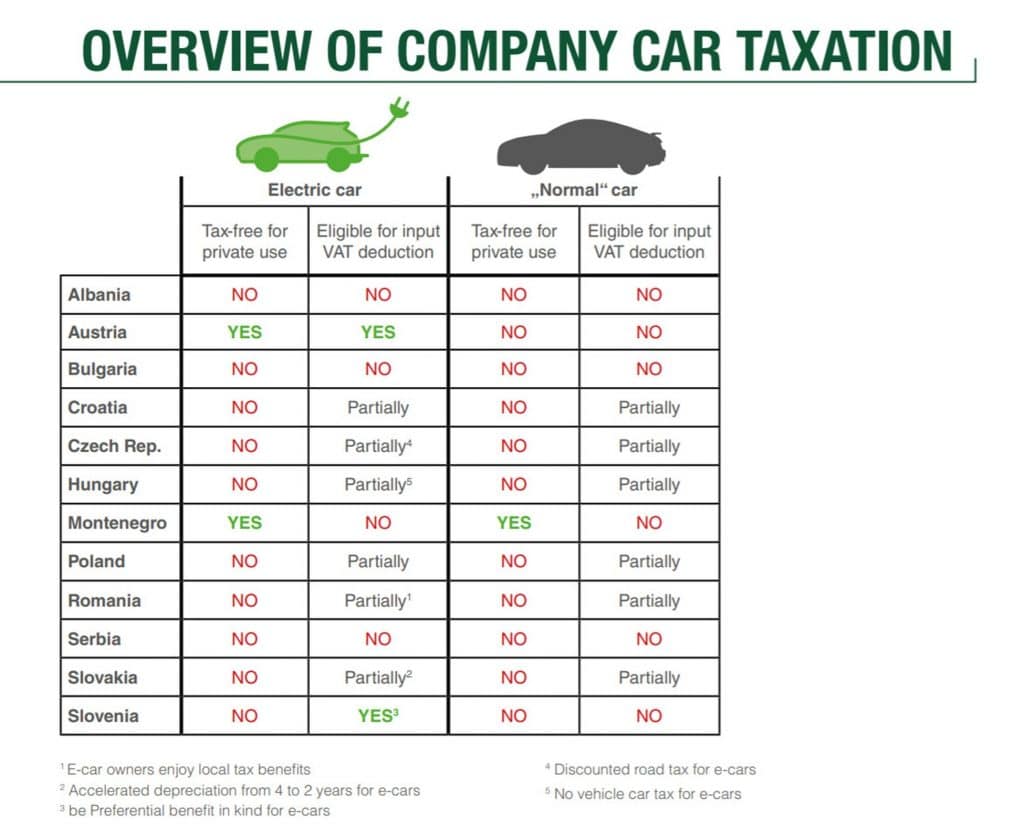

One example unearthed by the TPA study looks at various tax considerations for company cars across the region — a data point particularly compelling for managers and executives.

The research found that in Australia, there are significant tax-free benefits for those that opt for electric cars, while Poland, Slovakia and Romania, Croatia, the Czech Republic and Hungary have also started to promote e-mobility by offering incentives.

Another factor to consider, Mr Bauer-Mitterlehner said, was that those countries in the CEE region that are not part of the EU are able to offer generous subsidies to attract capital expenditure in the production sector.

“It is not only low-quality manufacturing though, in countries like Bulgaria and Serbia, they have a very active IT industry, and they also have some specialised people in engineering, for example Lufthansa has one of its biggest maintenance hubs in Bulgaria,” Mr Bauer-Mitterlehner said.

“There are a lot of very well educated, specialist engineers in these countries, but on a general level, there are still some poorer, rural regions where there are high unemployment rates, and they are happy to start with very basic work and they are really happy to get international investors there.

“Also, in these countries, there is no difference between women and men in terms of education.

“One of the big advantages of the former communist nations is they always took care of the diversity rules for men and women.”

Securing talent remains a challenge

While taxation is an important issue, Mr Haneder says it is often less important from an employer perspective than the availability of workers.

Like most economies across the globe, those in the CEE have not been immune to the labour shortages that have punctuated the pandemic.

While not a new phenomenon for countries located in CEE, labour shortages in 2021 were more pronounced than in the rest of Europe, particularly in services and construction.

“When we get questions from potential investors about the general situation in countries and the tax situation, the tax itself is never the dominating factor leading to an investment decision,” Mr Haneder said.

“It’s really more availability of staff and the cost of staff. “Businesses should not only consider the tax implications, but they should also know the business situation in the countries they are considering investing in.”