It’s estimated 1.7 billion adults across the globe are without a bank account. Could that section of the population hold the key to reviving national economies?

Holding physical cash is no longer smart. Among the many facets of daily life that have changed thanks to COVID-19, transactions using physical money have largely been abandoned in favour of contactless payments through mobile phones or tap-and-go cards.

With concerns that the virus can last up to nine days on surfaces, handing money over the counter is now seen as risky and establishments do not want to jeopardise the health of staff by accepting potentially ‘dirty’ money.

The resulting social change has been huge.

Mastercard estimates a 40 per cent growth in global contactless payments between March 2019 and March 2020, with 85 per cent of small payments (those under $USD25) now made using a card.

Visa has seen even bigger changes, reporting 150 per cent growth in contactless payment within the US, while in the UK, the use of automatic teller machines to access cash has fallen 60 per cent.

Even cash in circulation is out of favour — the US Federal Reserve is reporting it now quarantines bank notes for a period of time before entering the country.

Singapore’s DBS Bank noted that the volume of cashless transactions has nearly doubled in the first three months of 2020 compared with the same period last year.

The nation’s vast number of migrant workers were forced to adopt digital banking to remit funds as employment agencies ruled they must accept pay electronically.

China is also moving away from cash and gearing up for a sovereign digital currency, where everyday banking activities including payments, deposits and withdrawals would be from a digital wallet.

The wallet app would be installed on a mobile phone and allow money to be paid or received with merchants, ATMs or other people. Importantly, it will be able to be used without an internet connection.

But while COVID-19 has accelerated the movement to electronic transactions, it has also highlighted problems with access for those without a bank account — a vast group known as the unbanked.

How can the unbanked be unlocked?

For those who take banking for granted, it may come as a surprise that 1.7 billion adults across the globe lack an account at a formal financial institution.

The world’s two most populous nations, China and India, account for 415 million of the world’s unbanked. When joined with Pakistan, Indonesia, Nigeria, Mexico and Bangladesh, these countries are home to half the world’s unbanked population.

Ensuring financial inclusion for these citizens has long been a challenge but it has the potential to improve the day-to-day lives of citizens, allowing them to better run their businesses, buy a car or home, make more productive investments and live longer, healthier lives.

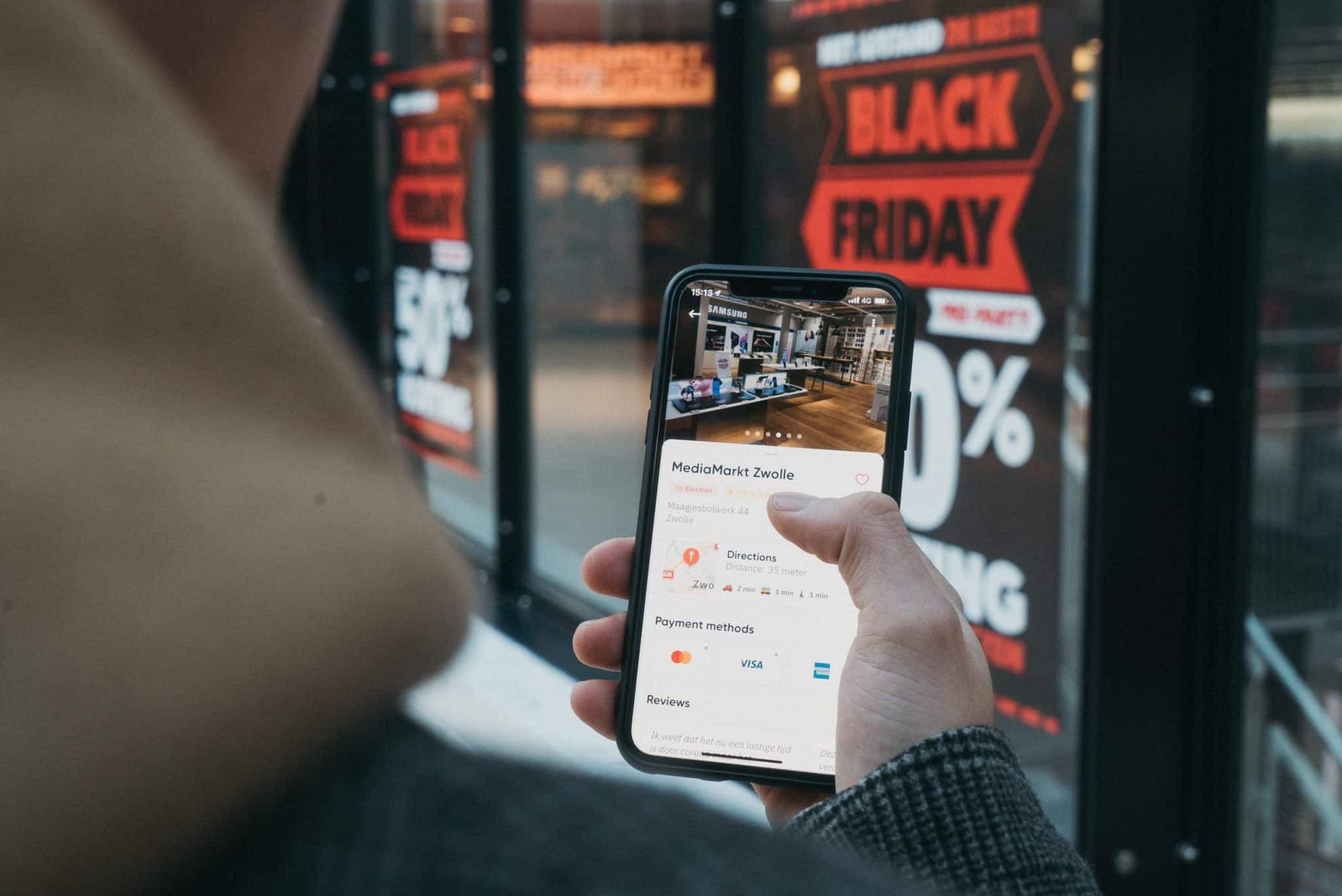

Initiatives to address the gap are on the radar for agencies such as the World Bank and the International Monetary Fund – and mobile devices and smartphones are emerging as potential liberators.

For while the unbanked may not engage in mainstream banking, World Bank research notes that two-thirds of that demographic own a mobile phone, which could help them access fast, online financial services.

This is where China’s pilot program could have a big impact. If the sovereign digital currency is a success, a mobile phone will make electronic banking services accessible to the 225 million people in China who don’t have a bank account.

For Harsh Maheshwari, Baker Tilly’s Regional Director Asia Pacific, the key lies in encouraging banking innovation and faster, more secure digital transactions to empower the population.

Technology allows consumers to leapfrog traditional bank accounts and instead use an online or mobile option in some countries, he says.

Fintech advances and the growth of cashless transfers through digital wallets or cryptocurrencies, for example, will increasingly let people make fast payments and access other financial products such as insurance and micro-credit.

“You don’t have to go to an ATM,” Mr Maheshwari says. “You can go to any store and make transactions using your phone.”

For governments, the prospect of a decline in cash transactions is appealing as they have long been seen as an enabler of black markets and tax evasion.

Digital payment platforms should allow jurisdictions to better track the movement of money across markets, while they may also cut expenses related to the production and disposal of cash in circulation.

Making money accessible

There are a variety of reasons given as to why people do not have a bank account.

In 2017, 25 per cent of US households were unbanked or underbanked according to a survey by the Federal Deposit Insurance Corporation.

More than half of respondent indicated that they did not have enough money to keep in an account, while 30 percent said they don’t trust banks.

A lack of access to banks was another common response, which has also been a problem for people in India and China. Nearly 80 percent of Indian people had a bank account in 2017, up from 53 percent in 2014 and many people joined the ‘newly-banked’ thanks to a Government scheme aimed at low-income households.

But financial inclusion is more than just having a bank account. Having an account and using one are different matters. An Al Jazeera report painted a classic picture of the underbanked, a man who now had a bank account but failed to see the point given that he was still unable to access credit.

Mr Maheshwari says that the scenario varies dramatically across Asia. Credit and other payment cards are still very popular in cities such as Hong Kong and Singapore, where there is a high banking penetration.

“The moment you look out of Singapore, there’s a massive amount of unbanked populations in countries like Myanmar, Thailand, Indonesia and Vietnam.”

In China, smart payments have been embraced through mobile apps such as Alipay and WeChat Pay, with even some beggars accepting cashless payments over phones.

In some poorer parts of the region, the unbanked rate soars.

“The moment you look out of Singapore, there’s a massive amount of unbanked populations in countries like Myanmar, Thailand, Indonesia and Vietnam,” Mr Maheshwari says.

Even in parts of the world that have a high banked population, some harbour concerns for the vulnerable in the community, including the unbanked, about the move away from cash.

In addition, cashless payments that are made over digital platforms may be vulnerable to fraud, unsecure transactions, data breaches and a lack of clear regulation.

Mr Maheshwari points out that different markets across Southeast Asia have different regulations, which could be an impediment at a time when payments are occurring in real-time across countries with different levels of financial services maturity.

“So, navigating the red tape and making sure there’s a seamless platform for people across Southeast Asia is going to be a challenge,” he says.

Business and government are moving to provide reassurance. In parts of the retail sector, pushback has occurred against going cashless and Amazon – the pioneer of cashier-free stores – has responded by agreeing to accept cash at some of its brick-and-mortar outlets.

In Sweden, where people have widely embraced the mobile payment app Swish, criticism has been directed at the move towards digital-only payment options at some stores, bars, restaurants and on public transport services.

As a consequence, Sweden’s central bank, the Riksbank, has proposed that big banks must provide ATMs across the nation to accommodate retirees, people with disabilities and newly arrived refugees who may struggle with digital transactions.

The start-ups leading the cashless drive

Businesses are responding to the payment evolution and meet the changing needs of consumers.

Ride-hailing company Grab, a Singapore-based technology enterprise that also offers food-delivery and payment solutions, launched peer-to-peer funds transfers to let users of its mobile wallet instantly transfer credits between each other.

Grab then extended the feature to include cashless transactions for merchants – typically in the food and beverage, retail and entertainment sectors – in a move that could also have significance for employers as they seek new, digital ways to pay employees.

Mr Maheshwari believes a faster payments environment will be good news for businesses trying to deal with perennial problems around cash-flow.

Whereas traditional cash cycles can take weeks or months, digital-wallet solutions can see payments being made in minutes or even seconds.

“So your working capital can be better managed,” Mr Maheshwari says. “You have more cash in hand and more liquidity and more flexibility to invest money in innovation or expansions.”

Cashless isn’t just for personal banking. Baker Tilly Strego’s Emmanuel Tariot says fintechs in Europe, such as QONTO, are challenging the banks in providing financial services.

QONTO is a neobank for small and medium enterprises, facilitating cash flow management for businesses and allowing them to make payments with a virtual card.

It is based in France and now operates in Italy, Spain and Germany, managing €10 billion in transaction volume during 2019.

“However, there are limits to using QONTO, which boils down to bank financing and cheque cashing,” Mr Tariot says.

“If the user company wishes to obtain financing, QONTO is not able to carry out bank loans. In addition, if the user company wishes to cash cheques, QONTO is capped at €3000 in cheque remittance.”

QONTO recently raised €104 million in Series C funding that will fuel its expansion into the three new markets it entered during 2019 – Italy, Spain, and Germany.

The investment will also help QONTO strengthen its position in France where the majority of its 65,000 SME and freelancer customers do business. It is also seeking a credit institution license during 2020 that will allow it to become a bank.

Cashless payments on the money in Africa

To get a sense of how widely cashless payments are being adopted in Zimbabwe, just step into a church.

As worshippers make donations to their parish, some are making them directly via the popular mobile-payments platform EcoCash rather than traditional cash collection plates.

“Even churches are using EcoCash to do their collections, so it’s interesting how mobile payments have changed the way people view money and transactions,” says Victoria Shumba, a business development executive in Baker Tilly’s Harare office.

EcoCash is the dominant mobile phone-based money transfer, financing and microfinancing service in Zimbabwe and competes with the likes of OneMoney and Telecash.

The services speed up business-to-business payments and allow citizens who have been shut out of traditional banking services to save, send and receive money using their digital wallets.

EcoCash joins a range of other digital payment options across Sub-Saharan Africa, including the well-established M-Pesa mobile wallet in Kenya, and Moneywave, a product created by a Nigerian startup enabling local merchants to send money anywhere in Africa to any bank account or digital wallet instantaneously.

Such technology is allowing citizens to leapfrog older technologies, including ATMs and online desktop banking, and move straight to the latest frictionless mobile infrastructure.

However, there is now greater scrutiny on transactions not linked to bank accounts as the Reserve Bank of Zimbabwe ramps up its battle against money laundering and illicit foreign currency dealers.

Mobile money providers are now regarded as financial institutions subject to apex bank oversight. The central bank directed EcoCash and other mobile money service providers (OneMoney, Telecash and MyCash) to freeze accounts belonging to agents with transaction activity above ZW$100,000.

On May 1, Ecocash and OneMoney were directed to freeze accounts of individuals and companies suspected to be involved in illicit foreign currency transactions and/or money laundering.

“There is a lot happening now which may impact the future of mobile money in Zimbabwe as the Reserve Bank seeks to reign in the parallel market and illicit financial trade,” Ms Shumba says.

“Unfortunately the innocent may get caught up with the guilty.”

As Zimbabwe’s currency declines in value, the ceiling has been revised on transaction limits:

- Peer to peer transfers up to ZW$5000 per transaction (previously limited to $1000)

- Merchant payments up to ZW$10,000 per transaction (previously limited to $3000)

- Bill payments up to ZW$10,000 per transaction (previously limited to $2000)

Daily transaction limits:

- EcoCash customers not linked to a debit card or bank account can transact up to ZW$5000 in any given day (previously $2000)

- EcoCash customers linked to a debit card have their limits increased to ZW$10,000 (previously $5000)

- EcoCash customers linked to a bank account can transact up to $25,000, (previously $10,000)

- A new class of customer, referred to as ‘Executive Grade’, are allowed to transact up to $30,000 in a day.

Monthly transaction limits:

- EcoCash customers not linked to debit card or bank account: up to ZW$20,000 (previously $10,000)

- EcoCash customers linked to a debit card: up to ZW$35,000 per month (previously $25,000)

- EcoCash customers linked to a bank account: up to ZW$150,000 (previously $50,000)

- Executive Grade customers: up to ZW$250,000.

COVID stimulus offers an unbanking cure

Economic stimulus measures in response to COVID-19 have, in some countries, included direct payments to citizens. In the US, and the average household will get $1523 under the $290 billion CARES Act. Some 60 million payments are being made through a direct deposit to people with bank account information on file with the IRS.

Payments will also be sent as a cheque in the mail but there were fears it could take as long as 20 weeks to reach households. For the millions of people whose lives revolve around cash, they will further lose out because cashing a cheque typically comes with a fee.

But the process has shone a light on ‘underbanking’ in the US — less an issue of unbanking in the country but reflective of the use of money services not backed by the FDIC.

These include a reliance on money transfer services, cheque cashing and the proliferation of high-interest, short-term or payday lenders, who dole out a remarkable $90 billion annually in loans.

But for those who opted for a paper cheque and haven’t received one yet, the payment may now look somewhat different.

As of May 18, some Americans will receive nearly 4 million EIPs via a free prepaid debit card, instead of cheque. The card, provided by MetaBank, will allow the user to make retail purchases, get cash from ATMs.

It’s not a bank account but the debit card can reasonably be expected to accelerate the move to cashless transactions for those who don’t have one.